YEREVAN (CoinChapter.com) — The cryptocurrency market remains unpredictable, with sharp price swings influenced by macroeconomic factors, regulatory shifts, and investor sentiment. Bitcoin and Ethereum have faced significant fluctuations, sparking concerns about another potential crash. We asked ChatGPT and GROK what they think—here’s what they said.

ChatGPT’s Perspective: Market Volatility and Risk Factors

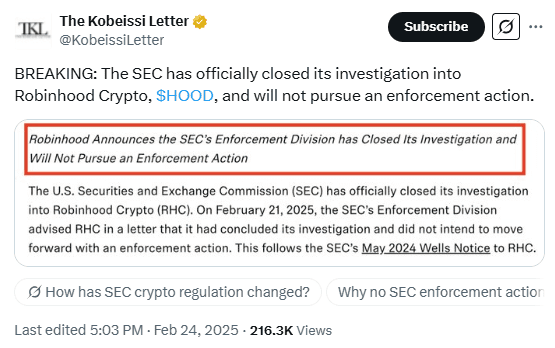

Under President Donald Trump’s administration, the U.S. Securities and Exchange Commission (SEC) has shifted toward a more lenient stance on cryptocurrency regulation. This change is evident as the agency moves away from aggressive enforcement actions seen in previous years. Notably, the SEC has closed investigations into major crypto firms without imposing penalties or legal consequences. One of the most significant examples of this shift is its recent decision to end its probe into Robinhood Crypto without taking further action, signaling a broader regulatory pivot.

SEC Closes Investigation Into Robinhood Crypto Without Enforcement Action. Source: The Kobeissi LetterSimilarly, the SEC has dropped its lawsuit against Coinbase, marking a big shift in its regulatory approach toward cryptocurrency exchanges. The lawsuit, initially filed in 2023, accused Coinbase of operating as an unregistered securities exchange and facilitating the trading of assets the SEC considered securities. The legal battle had been a focal point in the broader debate over regulatory clarity for digital assets in the U.S.

Coinbase Confirms SEC Lawsuit Dismissal, CEO Signals a New Era for Crypto. Source: Coinbase on XThe decision to withdraw the lawsuit suggests a departure from the SEC’s previous enforcement-driven approach under former Chair Gary Gensler. In addition to dropping cases against Robinhood and Coinbase, the SEC has also ceased legal actions against other major crypto firms, including OpenSea and Binance, reflecting a broader shift toward a more lenient regulatory stance under the current administration.

Establishment of the Crypto Task Force

In January 2025, Acting SEC Chair Mark Uyeda announced the formation of a new Crypto Task Force, a move signaling a major shift in the agency’s approach to digital asset regulation. Commissioner Hester Peirce, known for her pro-crypto stance, has been appointed to lead the initiative, which aims to establish a clear and predictable regulatory framework for cryptocurrencies and blockchain technology.

The Crypto Task Force is expected to replace the SEC’s previous “regulation by enforcement” strategy, which saw multiple lawsuits against crypto firms. Instead, the new approach focuses on developing transparent guidelines, fostering innovation, and engaging with industry stakeholders to create fairer regulations.

Hester Peirce Introduces SEC’s Crypto Task Force, Pledges Regulatory Clarity. Source: SECGlobal Regulatory Developments

While the U.S. adopts a more crypto-friendly approach, other regions maintain stringent regulations. The European Union’s Markets in Crypto-Assets Regulation (MiCA), fully applicable since December 2024, requires companies issuing or trading cryptocurrencies to obtain licenses and comply with strict compliance rules.

In the United Kingdom, the Financial Conduct Authority (FCA) continues to enforce a ban on crypto derivatives for retail investors, a policy some industry leaders argue may harm consumers more than protect them.

Liquidity Crisis and Exchange Collapses

The collapse of major exchanges has historically triggered market-wide liquidations. The downfall of FTX in 2022 and Terra’s ecosystem collapse in 2023 led to cascading sell-offs, liquidations, and investor distrust. If another key player—such as a major exchange or lending platform—faces insolvency, the industry could experience a significant liquidity crunch, driving prices downward.

Institutional Exit and Market Sell-offs

Institutional investors now play a crucial role in crypto market stability. Companies such as Citadel Securities entering the market indicate confidence, but large financial players are also quick to pull out when economic conditions shift. If macroeconomic instability increases or Bitcoin ETF inflows decline, massive institutional liquidations could lead to rapid price drops, similar to the market correction seen in mid-2021.

Macroeconomic Shocks

Global financial markets remain interconnected, and economic downturns impact risk assets like cryptocurrencies. Rising inflation, aggressive interest rate hikes by central banks, or a full-blown recession could shift investor sentiment away from volatile assets. The Federal Reserve’s monetary policy decisions, including potential rate hikes or cuts, will significantly influence whether investors see crypto as a hedge or a risk.

Market Resilience and Outlook

Despite past crashes, Bitcoin and the broader crypto market have demonstrated resilience, often rebounding after periods of downturn. Several factors suggest that while market volatility remains high, long-term structural shifts could provide support:

Bitcoin ETFs and Institutional Adoption

The approval and expansion of Bitcoin ETFs have introduced a new wave of institutional investment, allowing traditional market participants to gain exposure to crypto assets. If ETF demand continues to rise, this could provide a price floor, making Bitcoin more resilient to speculative sell-offs.

Blockchain Innovation and Adoption

Beyond price speculation, real-world blockchain adoption is advancing. Governments, financial institutions, and corporations are integrating blockchain technology into payment systems, supply chains, and digital identity verification. Continued adoption strengthens the fundamental value proposition of crypto assets, reducing the likelihood of extreme price crashes.

Market Maturity and Investor Behavior

Crypto market cycles have historically included euphoria, crashes, and recoveries. However, each cycle brings greater investor sophistication, improved risk management tools, and diversified portfolios. As the market matures, investors and institutions are developing better strategies to navigate volatility, potentially preventing extreme collapses seen in previous years.

Wyckoff Market Cycle: Understanding Accumulation, Bull, Distribution, and Bear Phases. Source: StockCharts & Wyckoff AnalyticsWill There Be Another Crypto Market Crash?

While crypto market crashes are inevitable, their frequency and severity depend on regulatory stability, liquidity conditions, institutional participation, and macroeconomic forces. The industry has grown significantly since the early days of Bitcoin, but its volatility remains tied to speculation, policy shifts, and market sentiment.

A sudden regulatory reversal or exchange collapse could trigger a downturn. Institutional participation provides stability but could also lead to mass sell-offs. Macroeconomic shifts, including inflation and interest rate decisions, remain key risk factors. Long-term adoption and innovation in blockchain technology may help buffer against extreme crashes.Ultimately, the crypto market’s next major crash is not a question of ‘if’ but ‘when.’ However, the factors shaping its recovery will determine whether it remains a speculative asset or evolves into a more resilient financial system.

Despite these risks, crypto markets have historically rebounded after crashes. Long-term adoption trends—such as Bitcoin ETFs and blockchain innovation—may help stabilize prices.

Cryptocurrency markets have long been a rollercoaster of euphoric surges and gut-wrenching collapses. Bitcoin, the bellwether of the space, soared to $69,000 in November 2021, only to plummet to $16,000 by November 2022 after the FTX exchange imploded, wiping out billions in value and trust.

More recently, Bitcoin hit a fresh peak of $105,000 in late 2024, driving the total crypto market cap past $2.9 trillion. That kind of explosive growth often signals a warning—history shows these highs are rarely sustainable without a correction lurking around the corner.

And that correction has now deepened. Just this week, Bitcoin tumbled below $90,000 on Feb. 25, 2025, hitting a low of $87,234—a roughly 17% drop from its late-2024 high. But by Feb. 27, the price had slid further to $86,214, as shown on recent charts, erasing over $230 billion from the broader crypto market cap in just a few days and dragging it down to $3.01 trillion.

This latest dip was sparked by a perfect storm of macroeconomic jitters and crypto-specific shocks. Fears of new U.S. tariffs under the Trump administration—potentially targeting imports from China and the EU as high as 20%, according to recent X posts and policy discussions—have stoked uncertainty, threatening global trade and economic growth. At the same time, U.S. Treasury yields on the 10-year note surged to 4.5% this week, up from 4.3% in January 2025, as inflation worries and a hawkish Federal Reserve outlook drew capital away from riskier assets like crypto.

Compounding the pressure, a $1.5 billion hack of the Bybit exchange on Feb. 24, one of the largest in recent history, sent shockwaves through the market—$500 million in user funds were drained, per blockchain analysts, eroding trust and triggering a wave of panic selling. The fallout saw $1.2 billion in liquidations across exchanges in a single day, with leveraged traders caught off-guard, further amplifying the sell-off and rattling investor nerves at a time when confidence was already fragile.

Altcoins took an even harder hit: Solana shed nearly 15%, while meme coins like Dogecoin and others saw losses deepen amid a fading speculative frenzy. Bitcoin ETF outflows surged, reflecting a retreat from risk assets amid market uncertainty. On February 24, 2025, $539 million was pulled out, driven by outflows from BlackRock’s IBIT ($158.6 million), Fidelity’s FBTC ($247.0 million), and others, totaling a significant drain after the Bybit hack and rising macroeconomic pressures. The trend continued on February 26, with $754.6 million exiting—BlackRock IBIT lost $418.1 million, Fidelity FBTC shed $145.7 million, and Grayscale GBTC dropped $56.0 million—marking the month’s largest single-day outflow and underscoring heightened investor caution. With February 2025 net outflows totaling $37.135 billion, these spikes signal a pivotal shift away from crypto amid Bitcoin’s plunge below $90,000 and fears of a broader correction.

This isn’t an outlier—it’s the crypto playbook. The 2022 crash followed a similar script: overheated markets, a major catalyst , and a brutal hangover. Today’s drop mirrors that volatility, with the Fear and Greed Index flipping from “extreme greed” (88 in November 2024) to a more cautious tone. Yet, some see opportunity in the chaos—analysts note Bitcoin’s oversold signals on daily charts, hinting at a potential rebound if it grabs liquidity below $90,000. . The question is whether this is a blip or the start of a deeper unraveling.

Overvaluation and Speculation

Market overheating remains a glaring risk. Analysts like Mark Zandi from Moody’s have flagged both stocks and crypto as looking overstretched, a sentiment that’s holding strong as of Feb. 27, 2025. Zandi’s long-standing caution—voiced loudly in late 2024 about “frothy” asset markets including stocks and crypto—feels prescient now, with no sign he’s backed off as markets gyrate.

The speculative fever in meme coins hasn’t cooled either: Dogecoin’s soared 107% and Pepe’s climbed 117% since their late 2024 highs, but both got clipped this week, shedding 10% and 13% respectively as the broader crypto market erased $300 billion in value on February 25.

Economic and Regulatory Risks

Economic headwinds could yank the rug out from under crypto. Rising U.S. bond yields are a big threat—back in 2022, the 10-year yield climbed from 1.33% to 4.3%, and Bitcoin cratered 64%. Today, yields are creeping up again, hitting 4.5% this week amid tariff fears and inflation chatter, pulling cash toward safer bets. Bitcoin’s $230 billion market cap wipeout on Feb. 25 proves the point—investors bolted as yields ticked higher. A global recession, hinted at by slowing growth signals on X, could make it worse, especially if risk-off mode deepens. Regulatory wildcards loom large too. Trump’s pro-crypto vibe—tied to his January 2025 inauguration—kept markets buoyant, but this week’s silence on crypto in his early moves has sparked jitters. A sudden crackdown elsewhere, like China’s past bans, could still ignite panic selling. The mix of economic pressure and policy roulette keeps the market on edge.

Signs of an Incoming Crypto Market Crash

Timing a crypto crash is a guessing game, but the market signals suggest late 2025 could be volatile if economic storm clouds keep gathering. Bitcoin’s 17% plunge from $105,000 to $87,234 on Feb. 25 already wiped out $230 billion in market cap, hinting at the risks ahead.Key warning signals to watch include:

Fear & Greed Index at extremes: In November 2024, the Crypto Fear & Greed Index reached a peak of 88, indicating a state of “Extreme Greed” in the market. However, by Feb. 27, 2025, the index had plummeted to 10, signaling “Extreme Fear.”This drastic shift from extreme optimism to severe pessimism often precedes periods of heightened market volatility and potential instability. Bitcoin ETF outflows accelerating: On Feb. 24, 2025, $539 million exited Bitcoin ETFs, followed by $754.6 million on Feb. 26, marking the largest single-day outflow of the month. This suggests institutional investors pulling back from risk assets. Rising futures liquidations: $1.2 billion in liquidations on Feb. 25 alone underscores the fragility of the market—leveraged positions were wiped out as prices tumbled. Bitcoin’s RSI signals oversold conditions: After hitting 83.88 (overbought) in November 2024, Bitcoin’s RSI has dropped to 35.64 on Feb. 27, suggesting increased selling pressure and possible further downside. Macroeconomic pressures mounting: U.S. Treasury yields have surged to 4.5%, a key risk factor that historically triggered Bitcoin downturns (e.g., Bitcoin fell 64% in 2022 when yields spiked from 1.33% to 4.3%). The threat of new tariffs under Trump’s trade policy is also spooking global markets.If these metrics align with worsening macro conditions—such as a global recession or further rate hikes—the next major crypto downturn could be deeper than this week’s preview.

The Bullish Counterpoint

Not everyone’s sounding the alarm. Some argue a full-on crash isn’t around the corner, even after this week’s shakeout. Bulls say that’s just noise; the long-term trend holds. Bitcoin’s halving cycles—next one due in 2028—have historically turned dips into springboards, like the rebound from $16,000 in 2022 to $105,000 last year. Long-term holders, unfazed by the $87,234 low, are still buying, with on-chain data showing accumulation below $90,000 this week. For them, volatility’s just a sale rack—crash or not, they’re betting on the decade-long uptrend.

The Bottom Line

The post We Asked ChatGPT and GROK About the Next Crypto Market Crash—Here’s What They Said appeared first on Coinchapter.

%%featured_image%%