YEREVAN (CoinChapter.com) — El Salvador, led by President Nayib Bukele, is closely monitoring the U.S. government’s decision to sell 69,370 BTC. The $6.7 billion Bitcoin comes from assets seized by the Department of Justice from the Silk Road dark web marketplace. This large-scale sale could disrupt the market, creating opportunities for buyers looking to capitalize on lower prices.

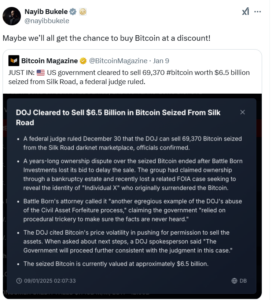

As Bitcoin prices experience volatility, President Bukele sees a potential for El Salvador to strengthen its reserves. He hinted on X,

Nayib Bukele Bitcoin Discount Tweet. Source: XBitcoin Prices Drop After U.S. Sale Announcement

Bitcoin’s price dropped 2.1% in the last 24 hours, trading under $93,000. Just two days earlier, Bitcoin surpassed the $100,000 mark. The decline is partly attributed to concerns over the impact of the U.S. Bitcoin sale on market liquidity. A large influx of BTC can lower prices, benefiting governments and investors seeking to buy at reduced rates.

Bitcoin Price Chart January 2025. Source TradingViewEl Salvador has been steadily acquiring Bitcoin. In the past week, the country purchased 18 BTC for $1.71 million, with 11 BTC bought on Jan. 9 alone.

El Salvador’s Growing Bitcoin Reserves

El Salvador’s Bitcoin strategy dates back to 2021, when the nation made BTC legal tender. Since then, the government has consistently expanded its holdings. As of now, the country’s Bitcoin reserves stand at 6,022 BTC, valued at approximately $557 million.

El Salvador Bitcoin Balance Growth. Source: Bitcoin OfficeThe Bitcoin Office of El Salvador shared a timeline of recent purchases, underscoring the government’s commitment to acquiring Bitcoin during favorable market conditions. Despite the risks, El Salvador continues to embrace Bitcoin as part of its financial strategy.

IMF Agreement Brings Changes to Bitcoin Law

In December, El Salvador amended its Bitcoin Law as part of a deal with the International Monetary Fund (IMF) to secure a $1.4 billion credit facility. The amendments make Bitcoin acceptance voluntary for merchants instead of mandatory, addressing the IMF’s concerns about price volatility and its impact on the country’s economy.

El Salvador remains one of the most prominent national proponents of Bitcoin. For now, the U.S. Bitcoin sale could provide a chance for President Bukele to acquire additional Bitcoin at a discounted rate, further strengthening the country’s position as a leader in Bitcoin adoption.

The post El Salvador Eyes Cheap Bitcoin Amid U.S. $6.7 Billion BTC Sell-Off appeared first on Coinchapter.